Indicators on Investment Representative You Should Know

Wiki Article

The smart Trick of Financial Advisor Victoria Bc That Nobody is Talking About

Table of ContentsThe Ultimate Guide To Independent Investment Advisor CanadaRetirement Planning Canada Fundamentals ExplainedThe Facts About Private Wealth Management Canada RevealedHow Private Wealth Management Canada can Save You Time, Stress, and Money.Independent Financial Advisor Canada for DummiesSome Known Incorrect Statements About Lighthouse Wealth Management

“If you used to be purchase something, say a television or a computer, you'll need to know the specs of itwhat tend to be its components and just what it is capable of doing,” Purda details. “You can remember getting monetary information and assistance in the same way. Men And Women have to know what they're getting.” With monetary advice, it’s vital that you keep in mind that the item isn’t ties, stocks and other investments.it is things such as cost management, planning for pension or reducing personal debt. And like buying some type of computer from a trusted company, buyers wish to know they have been getting economic advice from a reliable expert. Certainly one of Purda and Ashworth’s most interesting conclusions is just about the fees that monetary planners demand their customers.

This held true regardless the cost structurehourly, payment, assets under control or flat rate (into the learn, the buck worth of charges had been alike in each instance). “It nevertheless comes down to the worth proposition and anxiety on customers’ component that they don’t determine what they've been getting into change for these costs,” claims Purda.

Investment Representative Things To Know Before You Buy

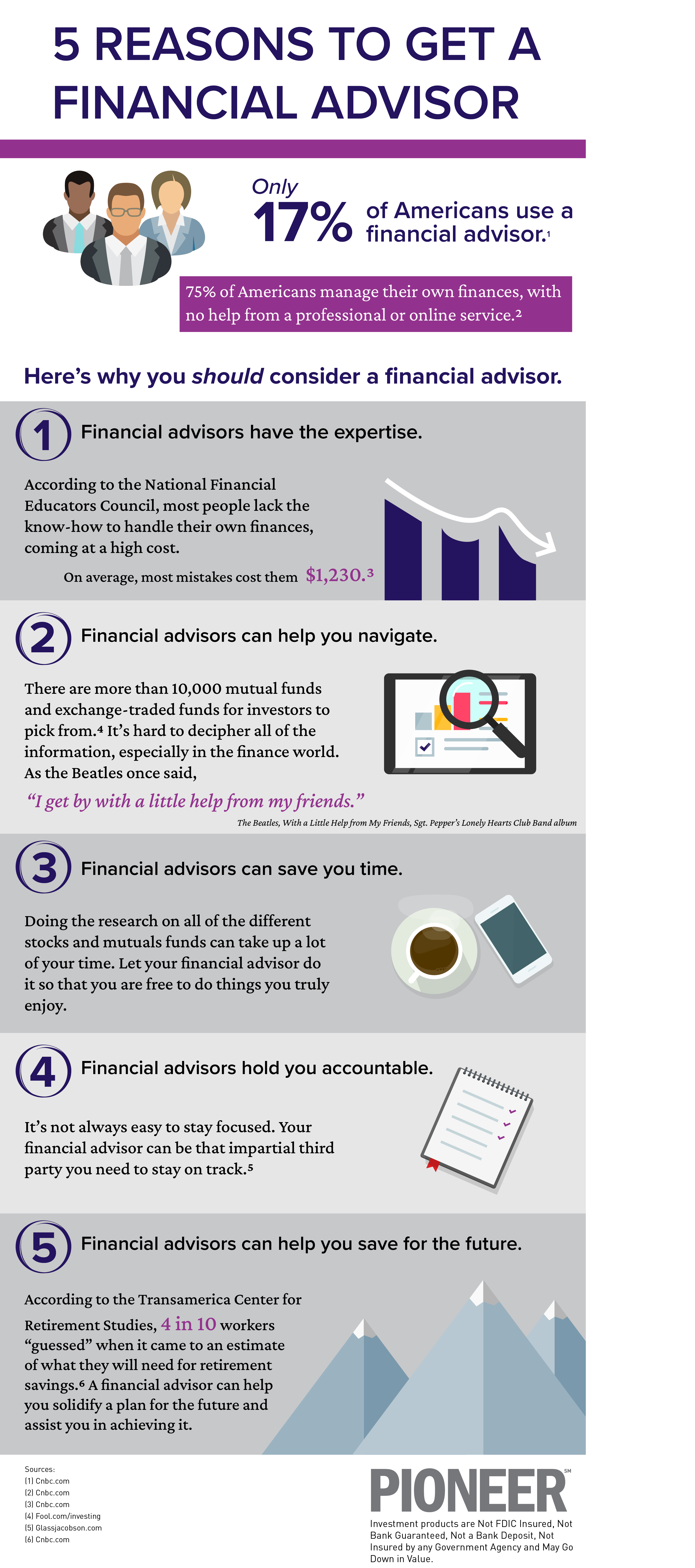

Tune in to this post as soon as you notice the term economic specialist, what pops into the mind? Lots of people consider a specialist who can provide them with financial information, specially when you are looking at trading. That’s the place to start, but it doesn’t decorate the complete picture. Not close! Financial analysts can people with a number of other cash goals also.

A financial consultant assists you to create wide range and protect it your long-term. They are able to estimate your personal future economic needs and program tactics to extend your retirement cost savings. They can additionally counsel you on when you should begin tapping into Social protection and using the cash within pension records to help you stay away from any unpleasant penalties.

The Greatest Guide To Independent Investment Advisor Canada

They are able to help you find out exactly what shared resources are right for you and demonstrate tips control and also make the most of one's financial investments. They're able to also allow you to see the risks and exactly what you’ll need to do to achieve your aims. A seasoned financial investment professional can also help you remain on the roller coaster of investingeven when your assets take a dive.

They are able to supply you with the direction you will need to generate a strategy to help you make fully sure your desires are carried out. And you also can’t put a cost label regarding the reassurance that comes with that. According to a recent study, an average 65-year-old couple in 2022 will need around $315,000 stored to pay for health care expenses in retirement.

Some Known Details About Ia Wealth Management

Since we’ve reviewed just what financial experts carry out, let’s dig to the differing kinds. Here’s good principle: All monetary planners are monetary advisors, although not all analysts are planners - https://lwccareers.lindsey.edu/profiles/4232859-carlos-pryce. A financial planner focuses primarily on helping folks develop intends to attain long-term goalsthings like beginning a college account or keeping for a down cost on property

So how do you know which monetary advisor is right for you - https://www.startus.cc/company/647135? Here are some things you can do to ensure you’re employing best person. Where do you turn when you yourself have two poor options to pick from? Effortless! Get A Hold Of a lot more options. The greater number of solutions you have got, the more likely you happen to be to manufacture good choice

The 25-Second Trick For Financial Advisor Victoria Bc

Our very own Intelligent, Vestor plan causes it to be simple for you by revealing you around five financial analysts who is going to serve you. The best part is actually, it is totally free to obtain associated with an advisor! And don’t forget about to come to the interview ready with a list of questions to inquire about so you can find out if they’re a great fit.But listen, just because a consultant is actually wiser compared to typical bear doesn’t give them the ability to inform you what to do. Occasionally, experts are loaded with on their own since they do have more levels than a thermometer. If an advisor begins talking-down for you, it is for you personally to demonstrate to them the entranceway.

Just remember that ,! It’s essential along with your financial specialist (the person who it eventually ends up getting) are on the same web page. Need an expert that a long-lasting investing strategysomeone here are the findings who’ll motivate one to keep investing constantly perhaps the marketplace is up or down. lighthouse wealth management. You additionally don’t want to utilize somebody who pushes you to definitely put money into something’s also high-risk or you’re not comfortable with

Retirement Planning Canada - Truths

That blend gives you the diversification you need to successfully invest for your long term. Whilst study economic experts, you’ll probably run into the word fiduciary responsibility. This all implies is any advisor you employ has got to act in a fashion that benefits their particular client and never their self-interest.Report this wiki page